6 minutes

6 minutesPositive operational performance and high utilization sustained amid significant deterioration of the international oil market due to COVID-19

Significant deterioration in the fuel market due to coronavirus, with falling demand and historically low refining margins

Crisis management without adverse effects on market operation and supply - Maintaining production at 3.7m MT

Adjusted EBITDA coming in at €191m in 1H20 and reversal of part of the losses in stocks from the fall of prices in the first quarter – Further improvement of the financial cost

Extensive maintenance and environmental investment program begins at the Aspropyrgos Refinery - Investment of € 130 m

The Group's Transformation Strategy is implemented, with development in RES - Important steps in the Digital Transformation program

Α) Key highlights in 2Q20:

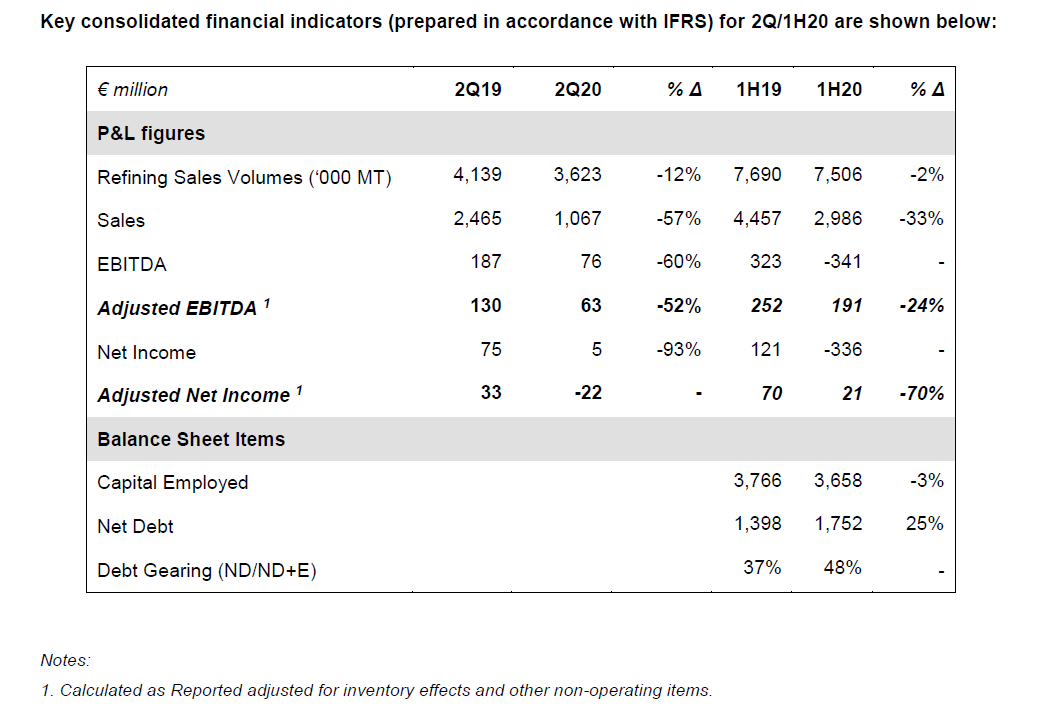

HELLENIC PETROLEUM Group announced its 2Q20 consolidated financial results, with Adjusted EBITDA coming in at €63m in 2Q20 and €191m in 1H20.

The last few months have been marked by a significant decline in global economic activity, while mobility restriction measures in response to the COVID-19 pandemic have led to a corresponding reduction in fuel demand. The crisis particularly affected the aviation sector with the air traffic reduction in the 2Q20 reaching 81%, while in Greece, tourist arrivals for the 1H20 were down by 77%. The significant drop in global product demand, combined with the agreement by OPEC++ to limit crude oil production resulting in an increase in crude oil prices, led to a decline of refining margins at historically low levels.

An important challenge faced by many refineries in the area, was the continuous operation of the units in an environment of significant challenges and the lack of product storage capacity. Despite the adverse conditions, the Group maintained high operating levels, with the production amounting to 3.7m MT, at the same levels vs 2Q19, utilizing the large storage capacity of its refineries, while, at the same time, proceeded with contango trades, avoiding excessive exposure to price risk and took advantage of the market structure to improve results from international trading.

With regards to the financial results in accordance with IFRS, the gradual recovery of crude oil and product prices, from the lows recorded in the beginning of 2Q, resulted to inventory valuation gains of €26m, partially offsetting the significant loss recorded in the 1Q20 and led Reported EBITDA to €76m.

Strong balance sheet, reduced financing cost

The Group continues its balance sheet management policy for the maximization of liquidity and sufficient funding. Discussions are underway for the refinancing of credit lines that mature in the coming months, in order to improve the maturity profile of the Group's debt liabilities.

Financing cost remains at the lowest levels in recent years, down 15% from last year. Net Debt in the 2Q20 stood at €1.8b, with the Gearing Rate at 48%, recording a decrease compared to the previous quarter.

Andreas Shiamishis, Group CEO, commented on results:

“We faced unprecedented conditions during 2Q20, affecting mainly oil products market, as mobility restrictions and air traffic drop led to significantly lower demand.

As expected, our efforts focused mainly on managing this crisis and adjusting our business model to the new reality. Results are positive, as we safely maintained high levels of operation, uninterrupted supply for all markets while taking advantage of commercial opportunities with positive contribution.

We also continued on our strategy implementation, with progress on the Kozani renewable project, the start of an integrated digital transformation program for the Group, as well as launching new high-value products at our network.

Our key objectives in the coming months are the successful implementation of the Aspropyrgos turnaround, as well as the acceleration of our growth strategy.”

Β) Strategy and main developments in 2Q20:

The gradual lifting of the COVID-19 measures from the middle of 2Q, both in our country and in the Mediterranean region, led to a recovery of economic activity and fuel consumption, which however is still lagging last year levels, especially in sectors such as tourism, air transport, and coastal marine. The Group closely monitors developments, with main priority the health and safety of its staff and contractors in its facilities, especially ahead of the turnaround of the Aspropyrgos Refinery, and adjusts its operations accordingly.

Investments of € 130 million in the Aspropyrgos Refinery

On 28 August, the full turnaround of the Aspropyrgos Refinery begins with the gradual temporary shut-down of the main units. The program will last 9 weeks, two more than planned, to include additional safety measures for COVID-19. The turnaround, with a total budget of €130m, is the largest similar project in the Group’s history. In addition to the maintenance at all units, it includes investments of €60m of projects focused on safety and environment, which will be implemented during the shut-down and are expected to further reduce the refinery’s particulate emissions (PMs) by 50%.

In the final line the creation of the largest PV Park in Kozani

Regarding the implementation of the Group’s strategy, in relation to the 204MW PV project in Kozani, for which the transaction is expected to be completed in the 3Q20, the technical configuration has been finalized, while the financing is expected to be arranged during 2020.

The tender process for DEPA is proceeding normally

Regarding the sale procedures of DEPA Commercial and Infrastructure, in which HELLENIC PETROLEUM participates, due diligence procedures are underway.

Added value to the Group since the launch of the Digital Transformation program

Finally, the digital transformation program was officially launched with total annual EBITDA benefits expected to exceed €50m in the next three years.

C) Domestic and international marketing:

The significant decline in refining margins and recovery of crude oil prices

Crude oil prices reached their lowest levels since 2003, with Brent prices at $30/bbl on average, dropping below $20/bbl during April, a $45/bbl decline since the beginning of the year. However, since May they recorded a gradual recovery, following the OPEC++ countries agreement.

Diesel and gasoline cracks, the main output of the Group's refineries, fell to multi-year lows due to the collapse of demand, especially in the first half of the 2Q20 and the high global inventories. Combined with the strengthening of Urals prices to higher levels than those of Brent, led benchmark refining margins to historically low levels. Specifically, the FCC margins averaged at $0.5/bbl, with Hydrocracking margins at $0.1/bbl.

The €/$ exchange rate remained at the same levels vs the previous quarter, as well as y-o-y, at an average of 1.10 for the 2Q20.

Domestic fuel market demand decline

The domestic ground fuels demand remained at the same level as last year, at 1.6m MT, as the fivefold increase in the heating oil market, due to mobility restrictions and low prices, offset the large decline of 24% in motor fuels consumption. The aviation and shipping fuels market recorded an even larger decline (-58%), due to a collapse in aviation fuel demand (-94%) and a reduction in shipping fuels demand of more than 40% in 2Q20.

D) Key highlights and contribution for each of the main business units in 2Q20:

REFINING, SUPPLY & TRADING

- Refining, Supply & Trading 2Q20 Adjusted EBITDA at €40m.

- Production amounted to 3.7m MT, at levels similar to last year, allowing the use of storage capacity for contago transactions, while sales amounted to 3.6m MT (-12%).

- High value-added products yield maintained at high levels, while the crude oil slate was significantly differentiated, due to the IMO operating model of the Aspropyrgos refinery.

PETROCHEMICHALS

Adjusted EBITDA amounted to €16m (-43%) in the 2Q20, mainly due to weak polypropylene benchmark margins.

MARKETING

In Domestic Marketing, the collapse of the aviation & bunkering market and the of demand drop in ground fuels, due to mobility restrictions, led to a significant decline in sales volumes and profitability with 2Q20 Adjusted EBITDA to €-1m.

In International Marketing, respectively, a decrease in volumes and contribution was recorded, with the Adjusted EBITDA of the 2Q20 at €10m (-30%).

ASSOCIATED COMPANIES

DEPA Group contribution to 2Q20 consolidated Net Income (excluding the positive impact of BOTAS case arbitration) came in at €1m.

Elpedison's EBITDA for the second quarter of 2020 amounted to €11m, significantly improved compared to last year, due to increased production.