5 minutes

5 minutesOperating performance helps to mitigate weakest refining environment in five years and leads to strong cashflow and improved balance sheet

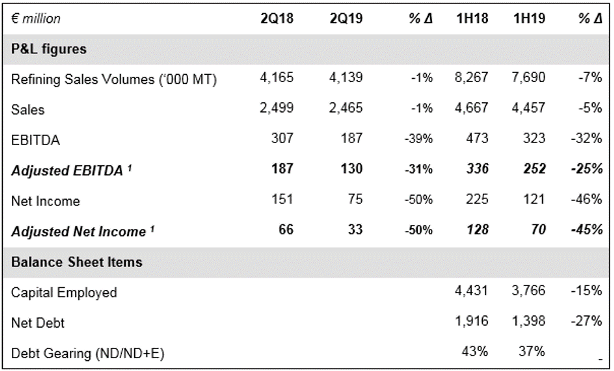

HELLENIC PETROLEUM Group announced its 2Q/1H19 financial results in accordance with IFRS. 2Q19 Adjusted EBITDA came in at €130m and 2Q19 Adjusted Net Income amounted to €33m, recording another quarter of positive performance. Despite a weak refining environment, results were positive on account of continued strong refining performance, the highest Petchems contribution on record, as well as continuous reduction in financing cost. International refining macro environment deteriorated to its lowest level in the last five years, as evidenced by record low benchmark refining margins and problems with Russian crude supplies into Europe due to the Druzhba incident. In this environment, the flexibility of the Group's refineries to process a wide range of crude grades, enabled uninterrupted supply and optimized operation, as well as capturing opportunities in lighter crudes pricing. Production remained at high levels (3.7m MT) and sales at 4.1m MT, flat y-o-y, with 57% of total sales directed to exports markets underlying the strength of Greek refineries in the region.

Contribution by Fuels Marketing and Petrochemicals was also increased, with Petchems recording an historical record Adjusted EBITDA of €28m. Furthermore, Marketing companies’ performance improved and interest costs reduction continued, as refinancing plans were implemented and balance sheet remains very strong.

IFRS Reported Net Income amounted at €75m, affected by inventory gains of €59m, while it should be noted that the results include for the first time the impact of new IFRS 16 on operating leases of retail fuel stations and other equipment.

With regard to the upcoming changes to bunkering fuel specifications, (IMO 2020), one of the most significant challenges for the global refining industry in recent years, the Group is on track with its plans to be able to deliver very low sulphur fuel oil by the beginning of 2020. An extensive test of new crude grades mix was conducted recently at Aspropyrgos refinery, yielding positive results, in terms of both quality and specs of the new 0.5% fuel oil, as well as the operation of the refinery’s conversion units. We expect that HELPE refining system will be ready on time to cover the Greek bunkering market with the new type of fuel, as well as maintaining its ability to serve customers who opt for the scrubber solution and require high Sulphur fuels.

Complex refining margins at the lowest levels in five years

International crude oil prices increased from $64/bbl on average in 1Q19 to $69/bbl in 2Q19, with volatility during the period, reflecting global macroeconomic and geopolitical developments.

In the European oil market, the contamination of significant quantities of Russian crude oil in the Druzhba pipeline, which supplies Central and Eastern European countries, disrupted the supply of Russian crude in the wider region, for most in 2Q19. As a result, the availability and pricing of Urals, as well as other high sulphur grades, which were called to substitute Urals deliveries shortfall, presented significant challenges during this quarter. This, combined with weaker cracks for most products, led complex refinery margins to multi-year lows. FCC margins were 40% lower to $3.2/bbl. Naphtha cracks drop to the lowest level in the past seven years led Hydrocracking margins to $1.3/bbl, while Aspropyrgos and Thessaloniki refineries benefitted from the reforming spread, highlighting HELPE’s refinery system ability to capture opportunities from changing market conditions. With the restoration of the Russian crude oil supply infrastructure in eastern Europe, the market appears to gradually recover, with margins normalising as early as the end of 2Q19.

The Euro/USD exchange rate averaged at €1.12, with the dollar strengthening further to a two-year high, with a positive impact for European refining sector.

Increasing demand for domestic fuels market

Domestic fuel demand in 2Q19 amounted to 1.6m MT (+4%), mainly due to increased heating gasoil consumption, while auto-fuels demand was flat. Aviation and bunkering fuels rose 9% to 1.2m MT, mainly on account of increased international marine consumption, with all markets improving.

Strong balance sheet, considering options for improving capital structure

Net Debt at €1.4bn, c.€500m lower y-o-y and Gearing at 37%, an additional drop vs 1Q19, further strengthened the Group's balance sheet.

It is noted that the Group fully repaid its €325m 5.25% Eurobond issued in 2014, out of own cash balances, which will lead to additional drop in finance costs.

The Group, as part of its financial plan for capital structure optimization and taking into account improved capital markets conditions and yields of its existing bonds, is considering a new bond issue in 2019, subject to market conditions.

Key strategic developments

In E&P, on 27 June 2019 the Lease Agreements for the two offshore areas of 'West Crete' and 'Southwest Crete' were signed (Total 40% - Operator, ExxonMobil 40%, HELLENIC PETROLEUM 20%) and are expected to be ratified by the Greek parliament, in order for the exploration works to commence. During 2Q19, planned environmental and exploration studies in other Western Greece concessions continued.

In addition, on 26 July 2019, ELPEDISON BV, in which HELLENIC PETROLEUM Group holds 50%, completed the acquisition of a 24.22% stake in ELPEDISON SA from the ELLAKTOR and ELVAL-HALCOR groups for a consideration of €20m in cash, with ELPEDISON BV now owning 100% of ELPEDISON SA's share capital.

Finally, on 07 August 7 2019, a new Board of Directors of HELLENIC PETROLEUM SA was put in place with Mr. Ioannis Papathanassiou elected as Non-Executive Chairman and Mr. Andreas Shiamishis as the Group CEO.

Key highlights and contribution for each of the main business units in 2Q19 were:

REFINING, SUPPLY & TRADING

- Refining, Supply & Trading 2Q19 Adjusted EBITDA at €69m (-50%), on account of significant benchmark margins drop.

- White products’ yield remained at 84%.

- Sales remained at the same level as of 2Q18, leading to total 2Q19 sales of 4.1m MT (-1%).

PETROCHEMICALS

- PP sales growth led to a record high Adjusted EBITDA of €28m (+ 3%) in 2Q.

MARKETING

2Q19 Marketing Adjusted EBITDA at €36m (+44%), following IFRS 16 implementation, while comparable performance improving vs LY.

In Domestic Marketing, sales volumes were flat vs 2Q18, with 2Q19 EBITDA at €21m (+81%).

- International Marketing volumes increased by 3%, with EBITDA at €15m (+12%).

ASSOCIATED COMPANIES

2Q19 DEPA Group contribution to consolidated Net Income was reduced (€0m vs €4. In 2Q18), following the de-consolidation of DESFA.

Lower production due to Thisvi plant shut-down, as well as the absence of a Flexibility Compensation Mechanism, led Elpedison's 2Q EBITDA to negative levels (€-4m).

Key consolidated financial indicators (prepared in accordance with IFRS) for 2Q/1H19 are shown below:

Notes: 1. Calculated as Reported adjusted for inventory effects and other non-operating items.

Further information:

V. Tsaitas, Investor Relations Officer

Tel.: +30-210-6302399

Email: [email protected]