4 minutes

4 minutesSatisfactory performance sustained, despite weaker benchmark refining margins; Higher volumes in the Greek market

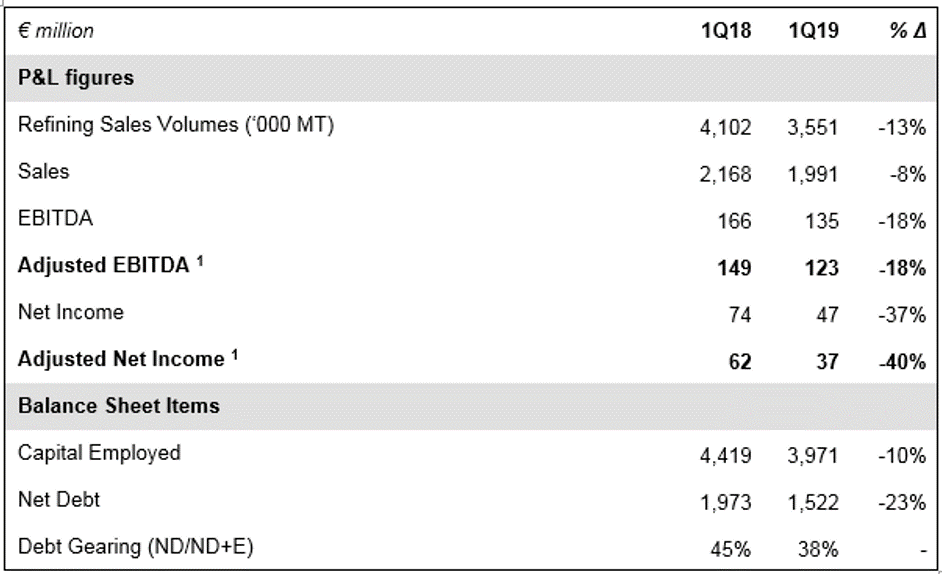

HELLENIC PETROLEUM Group 1Q19 Adjusted EBITDA came in at €123m, with Adjusted Net Income at €37m, recording one more quarter of good results and in line with expected industry performance. The drop in benchmark refining margins, mainly on account of the lowest gasoline and naphtha cracks during the last four years and reduced crude availability in the region, as well as maintenance driven production, decrease at 3.6m MT (-9%), led to a negative impact on quarterly operational profitability vs 1Q18.

A mitigating factor to the weak refining environment and crude supply issues has been the flexibility of Group’s refineries in processing varied crude grades allowing a sustained over-performance as well as a stronger USD exchange rate. On a comparable basis, non-refining business units’ performance at similar levels as 1Q18, contributing by 37% to Group Adj. EBITDA.

With respect to financing costs, a further drop of 16% reflects debt reduction as well as better pricing on account of renegotiation of existing debt facilities. Equity consolidated Power & Gas contribution to Net Income is up (+30%), despite DESFA sale and deconsolidation.

Based on the results above and the positive impact of increasing crude oil prices during the quarter, 1Q19 Reported Net Income amounted to €47m, with results including for the first time the impact of new IFRS 16 on operating leases of retail fuel stations and other equipment.

Benchmark refining margins significantly weaker in 1Q19

During 1Q19, crude oil prices moved higher from the 2018 year-end lows of $50/bbl, reaching $70/bbl at the end of the quarter, mainly due to geopolitical developments and OPEC’s decision to reduce crude supply. The lower availability of sour crude grades in the Med led to their prices exceeding those of Brent for the first time since 2013, with negative impact on benchmark margin calculation. This, combined with particularly weak light ends cracks, resulted to complex Med benchmark margins at their lower levels for at least 4 years. Med FCC benchmark margins were 29% lower, averaging $3.4/bbl, with Hydrocracking at $3.7/bbl (-31%).

EUR/USD was flat vs 4Q18, at 1.14, with the USD stronger vs 1Q18.

Increased heating gasoil and bunkering fuels demand

Domestic market fuels demand came in at 1.8m MT (+5%), as heating gasoil consumption was higher (+21%), due to weather conditions, while auto-fuels demand dropped marginally. Aviation and especially bunkering fuels demand recorded another increase (+15%), at 831k MT, mainly on account of increased international marine offtake.

Further balance sheet improvement and financing expenses drop

A reduction of financing expenses was reported for one more quarter and is expected to continue in coming quarters, following the recent renegotiation of existing bank facilities, as well as the repayment of the €325m Eurobond, which matures on 4 July 2019, out of cash reserves.

Overall, Group balance sheet remains strong, with Net debt at €1.5bln, flat q-o-q and debt gearing at 38%, significantly improved vs 1Q18.

The implementation of the new IFRS 16 affected the accounting of operating leases, with a positive EBITDA impact of €9m in 1Q19, mainly in Domestic Marketing, while financial liabilities (mostly retail stations leases) increased by c.€175m.

Key strategic developments

In E&P, on 9 April 2019 the Lease Agreements for Block 10 (HELPE 100%) and Block Ionian (Repsol 50% - operator, HELPE 50%) were signed, while during 1Q19 the scheduled environmental and exploration studies in other W. Greece concessions continued.

Key highlights and contribution for each of the main business units in 1Q19 were:

REFINING, SUPPLY & TRADING

Refining, Supply & Trading 1Q19 Adjusted EBITDA at €80m (-29%), on account of weaker benchmark margins.

White products’ yield remained at 85%, despite the negative impact of maintenance shut-downs.

- Exports were affected by lower refinery utilisation, leading to total 1Q19 sales of 3.6m MT (-13%).

PETROCHEMICALS

- Higher sales volumes partly offset weaker PP margins, with 1Q19 Adjusted EBITDA at €25m (-4%).

MARKETING

1Q19 Marketing Adjusted EBITDA at €20m (+46%), following IFRS 16 implementation, while comparable performance was at a similar level to last year.

In Domestic Marketing, sales volumes were up 5%, on increased heating gasoil demand, with 1Q19 EBITDA at €9m.

International Marketing volumes increased by 8%, with EBITDA at €11m (+4%), while construction works for the new fuels terminal in Cyprus commenced.

ASSOCIATED COMPANIES

1Q19 DEPA Group contribution to consolidated Net Income amounted to €17m. This is up from last year as a result of a combinations of factors, including the different Group structure, with DESFA no longer included, while ownership and consolidation method for regional gas retail and distribution companies has changed.

The application of flexibility compensation mechanism independent power generators, as well as increased production, led Elpedison’s EBITDA at €11m in 1Q18, notably higher vs 1Q18.

HELLENIC PETROLEUM Group of Companies

Key consolidated financial indicators (prepared in accordance with IFRS) for 1Q19 are shown below:

Notes: 1. Calculated as Reported adjusted for inventory effects and other non-operating items. 1Q19 results includes IFRS16 impact.

Further information:

V. Tsaitas, Investor Relations Officer

Tel.: +30-210-6302399

Email: [email protected]